Explore the UK’s Wage Growth and Inflation Landscape: Dive into key figures, real wages, and the impact on the economy in our insightful report.

In recent times, UK households have faced significant financial challenges, with wages struggling to keep pace with rising prices. However, a recent report from the Office for National Statistics (ONS) brings some positive news. We will explore the key figures and their implications for Britons and the broader UK economy.

- Average regular weekly earnings in the UK experienced an impressive 7.8% growth in the three months to July, the highest since 2001.

- The concept of real wages, which accounts for earnings growth after adjusting for inflation, is discussed, and it’s noted that real wages matched the Consumer Prices Index (CPI) inflation level in the mentioned quarter.

- Despite wage stabilization, the cost-of-living crisis persists, as inflation remains well above the Bank of England‘s 2% target. Future inflation figures will be closely watched for signs of easing or potential resurgence.

- The content highlights concerns from the Bank of England regarding the potential for continued wage increases to fuel inflation, possibly creating a self-reinforcing wage-price spiral.

- Future Wage Growth and Interest Rates: Signs are observed that wage growth may have peaked and could slow down. This is influenced by factors like rising unemployment rates, economic uncertainty due to the cost-of-living crisis, and potential interest rate hikes. The content notes the possibility of a rate increase from 5.25% to 5.5% and speculates on the future trajectory of interest rates.

If you are getting valuable information from the post,’Navigating the UK’s Wage Growth and Inflation Landscape’, then read below for more information.

READ THIS:

- Anticipated 8.5% State Pension Increase May Push Additional 650,000 People into the Income Tax Bracket

- Maximizing Savings in High-Interest Environments: 10 Expert Tips to Boost Your Financial Growth

The 7.8% Wage Growth Milestone

The ONS reports that average regular weekly earnings growth remained at an impressive 7.8% in the three months to July. This figure is the highest recorded since comparable records began in 2001.

Real Wages vs. Inflation

Real wages, which account for earnings growth after adjusting for inflation, are a critical measure for households. In the latest data, real regular wages, excluding bonuses, matched the Consumer Prices Index (CPI) inflation level in the quarter to July.

Is the Cost-of-Living Crisis Over?

While the stabilization of real wages offers relief to many struggling households, it’s important to note that inflation remains significantly above the Bank of England’s 2% target. The upcoming inflation figures will provide insight into whether inflation is easing or potentially resurging, impacting workers’ purchasing power.

If you are getting valuable information from the post,’Navigating the UK’s Wage Growth and Inflation Landscape’, then read below for more information.

Implications of Record Wage Growth

Record wage growth may have unintended consequences. The Bank of England is concerned that sustained wage increases could fuel further inflation, potentially creating a wage-price spiral.

The Future of Wage Growth

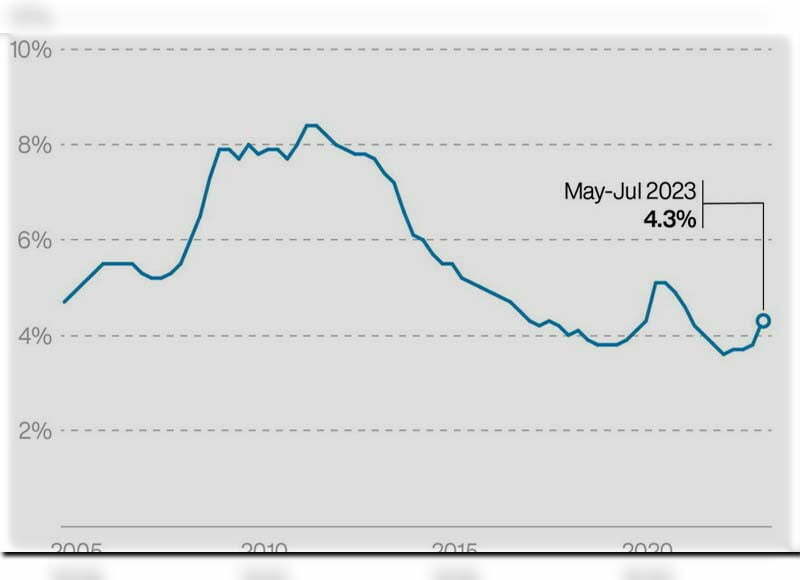

Economists are observing signs that wage growth may have reached its peak and is poised to decelerate. Factors such as rising unemployment rates and economic uncertainty due to the cost-of-living crisis and multiple interest rate hikes may influence wage demand.

If you are getting valuable information from the post,’Navigating the UK’s Wage Growth and Inflation Landscape’, then read below for more information.

READ THIS: Lloyds Bank Passbook Savings: Worries for Senior Clients and Prospects of Branch Shutdowns

Impact on Interest Rates

The strength of wage growth is a key factor that could prompt the Bank of England to increase interest rates from 5.25% to 5.5% at its upcoming meeting on September 21. However, some experts believe that this may represent the peak, with expectations of rate stabilization and eventual reductions in the coming years.

The balance between wage growth and inflation in the UK remains a dynamic and crucial issue with significant implications for households, businesses, and the overall economy.

If you are getting valuable information from the post,’Navigating the UK’s Wage Growth and Inflation Landscape’, then share it and don’t forget to click on notification button.