Read this to know how to multiply returns with dividend stocks and compound growth. Learn how to effectively multiply your returns using dividend stocks and the power of compound growth. Discover the strategy to build a second income through long-term investing and regular contributions.

Investing in dividend stocks can be a powerful strategy to generate passive income over the long term. While it might seem challenging to generate substantial returns with limited capital, a systematic approach, compound returns, and regular contributions can turn a modest investment into a significant second income. Let’s explore how this can be achieved.

READ THIS:

- Investing for a Greener Future: NS&I’s 5.7% Green Bond Unveils Profitable Sustainability

- Decoding Nvidia’s Valuation: Strong Results, AI Dominance, and Investment Insights

The Initial Challenge: Limited Passive Income

With a starting investment of £1,000, generating a significant annual passive income might appear difficult. A realistic yield of around 8% could generate approximately £80 a year. However, this might not be a life-changing amount for many individuals, and it’s this perception that often discourages Britons from investing.

The Long-Term Approach: Creating Lifelong Income

Taking a long-term perspective can completely change the equation. Compound returns and consistent contributions play a pivotal role in transforming a small investment into a substantial second income.

Utilize a Stocks & Shares ISA for Tax Efficiency

A Stocks & Shares ISA is an excellent choice for creating passive income, as all returns generated within the ISA wrapper are tax-free. Setting up an account is straightforward and can be done quickly with various investment platforms. While platforms like Hargreaves Lansdown are popular, individuals with limited capital might prefer platforms with lower fees.

Set Clear Objectives and Define Affordability

Defining investment goals and understanding what’s feasible within your financial capacity is crucial. To achieve significant passive income, it’s evident that more than £1,000 in dividend stocks is needed. This necessitates a systematic savings strategy, ideally on a monthly basis, to steadily build and expand the investment portfolio.

READ THIS: Nvidia Shatters Records: Riding the AI Boom to All-Time Highs and Trillion-Dollar Valuation

Harness the Power of Compound Returns

Compound returns are a key factor in long-term wealth accumulation. This strategy involves not only earning from the initial investment but also reinvesting accumulated interest or profits, leading to exponential growth over time. Whether through share price gains or dividends, reinvesting returns along with regular contributions can magnify wealth growth.

Illustrating Growth with Compound Returns

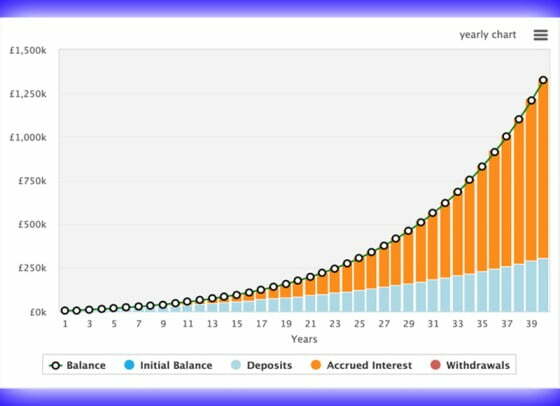

Visualizing the potential growth of an investment portfolio with compound returns showcases the substantial impact. Assuming an 8% annualized return and a consistent monthly contribution of £200, the portfolio could experience remarkable growth over time, especially when accounting for a 5% increase in contribution size to combat inflation.

Making Informed Investment Choices

Achieving a growth rate better than 8% requires making wise investment decisions. Conduct thorough research and due diligence to ensure the selected dividend stocks have strong potential for growth and stability.

Dividend Stocks and Compound Growth: The Lifelong Second Income

The magic of compound returns becomes apparent when considering the potential second income over various timeframes. After 20 years, the investment could yield £13,000 annually. After 30 years, it could increase to £38,000, and after 40 years, the potential income could reach £100,000 annually.

In conclusion, investing in dividend stocks with a long-term perspective, utilizing compound returns, and making consistent contributions can transform a small investment into a substantial and lifelong second income. With the power of compounding, strategic choices, and disciplined savings, the potential for financial growth becomes promising.

Disclaimer: Investment involves risk and it’s important to conduct thorough research and seek professional advice before making any financial decisions.

After reading the post ‘Unlocking Lifelong Income: How to Multiply Returns with Dividend Stocks and Compound Growth‘, please read below posts.

READ MORE:

- Investing for a Greener Future: NS&I’s 5.7% Green Bond Unveils Profitable Sustainability

- Extended Help to Save Scheme Provides Assistance to 3 Million, Unlocking Up to £1,200 Bonus

FAQs

Question: What is the advantage of taking a long-term approach to investing with dividend stocks?

Answer: A long-term approach to investing with dividend stocks allows for the potential of compound returns and the creation of a lifelong second income.

Question: How can a Stocks & Shares ISA contribute to generating passive income?

Answer: A Stocks & Shares ISA offers tax-free returns, making it an excellent vehicle for creating passive income from investments.

Question: What is compound growth, and how does it contribute to wealth accumulation?

Answer: Compound growth involves reinvesting accumulated interest or profits, leading to exponential growth over time, and can significantly boost investment returns.

Question: How can regular contributions and compound growth turn a small investment into a significant second income?

Answer: By consistently reinvesting returns and making regular contributions, even a modest initial investment can grow substantially over time, potentially yielding a significant second income.